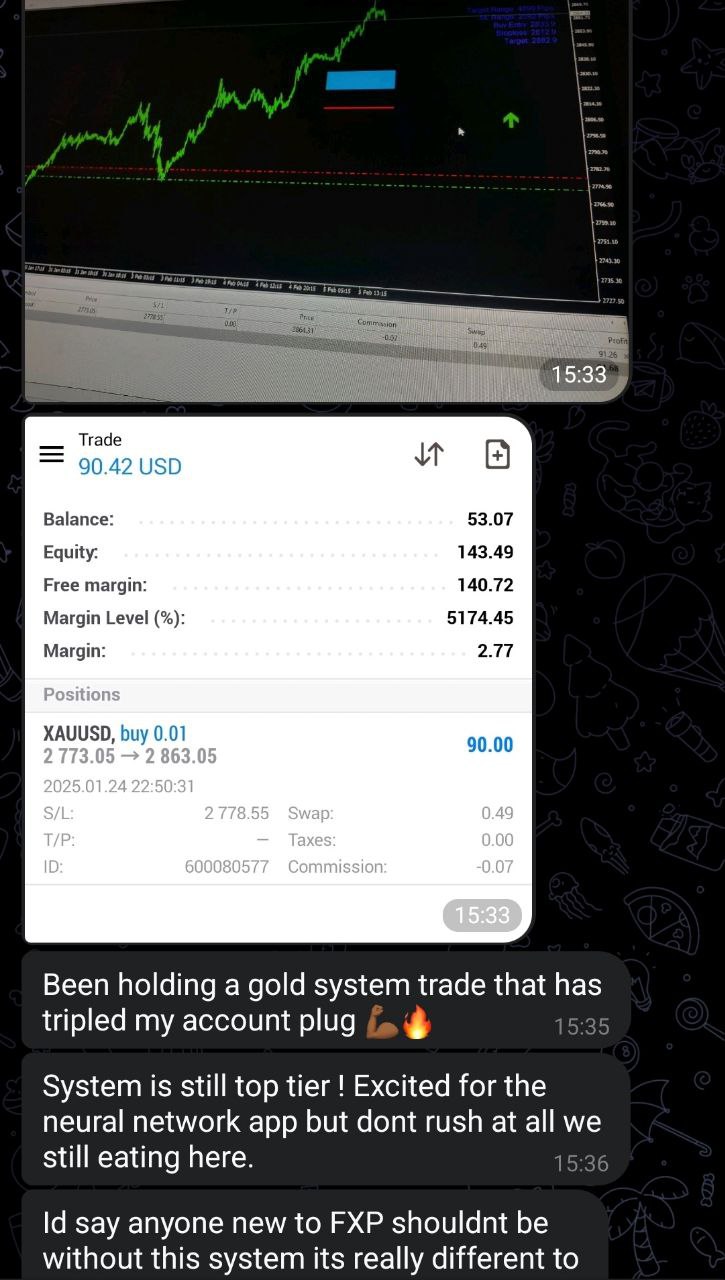

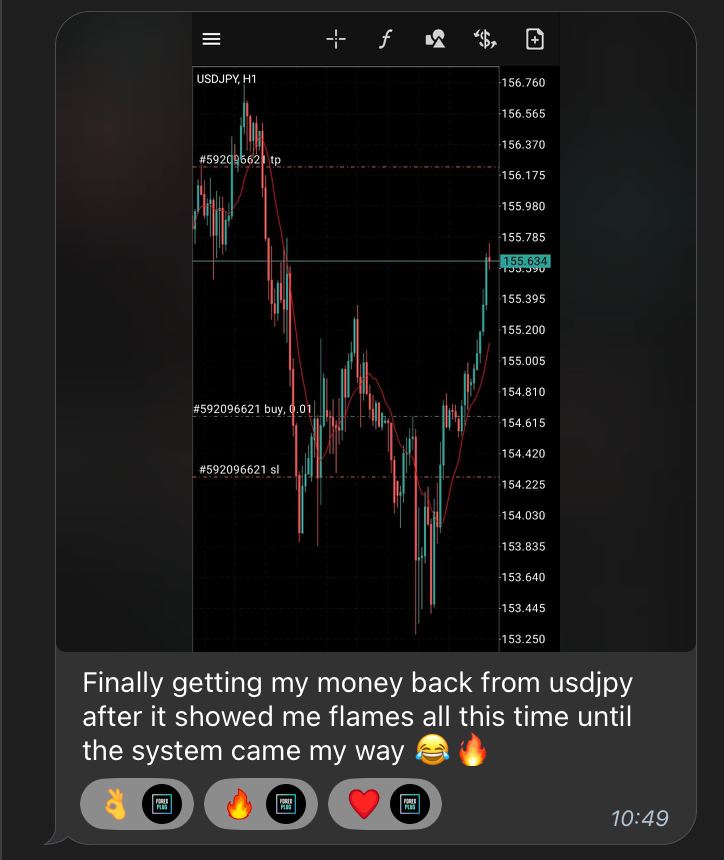

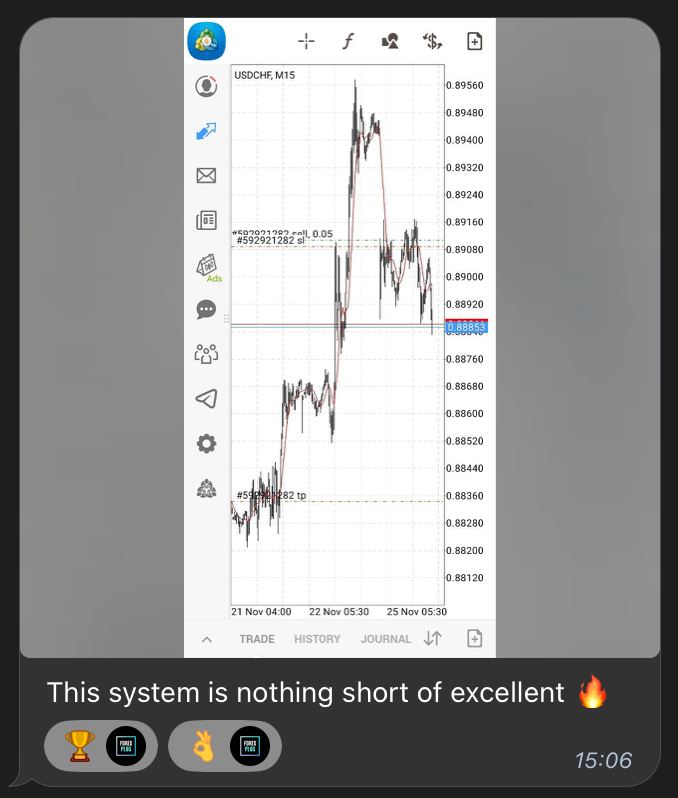

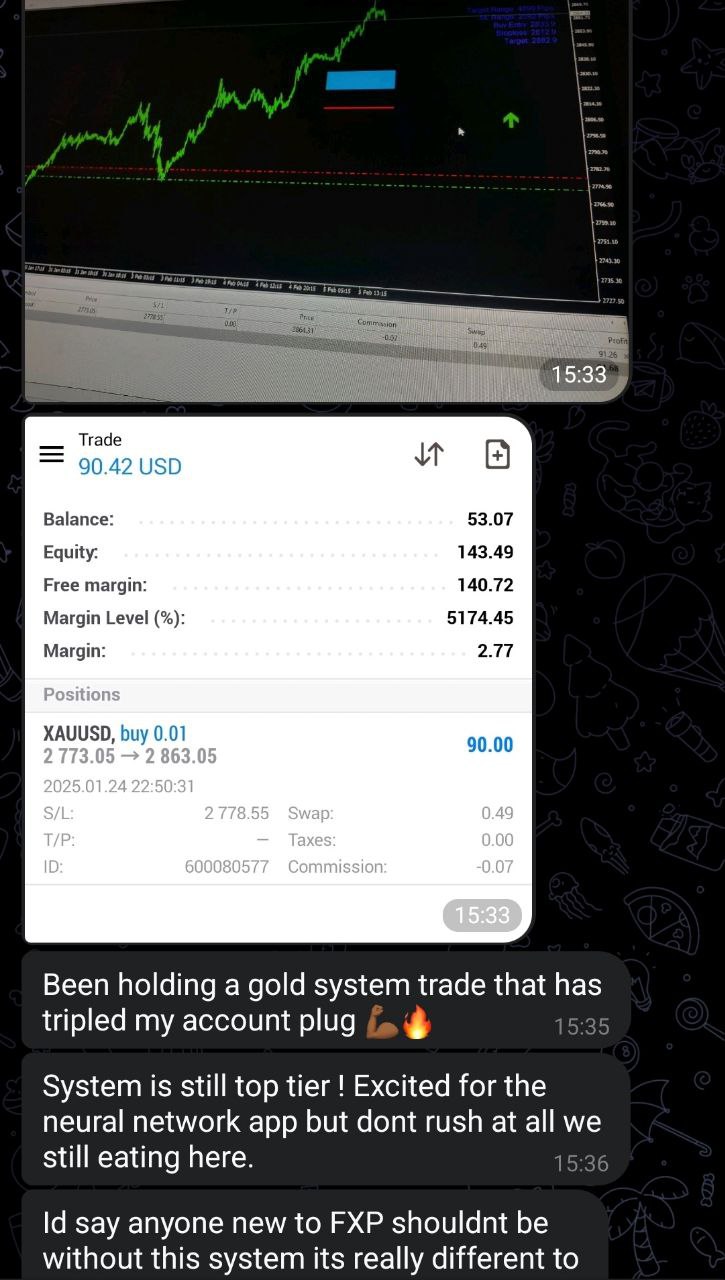

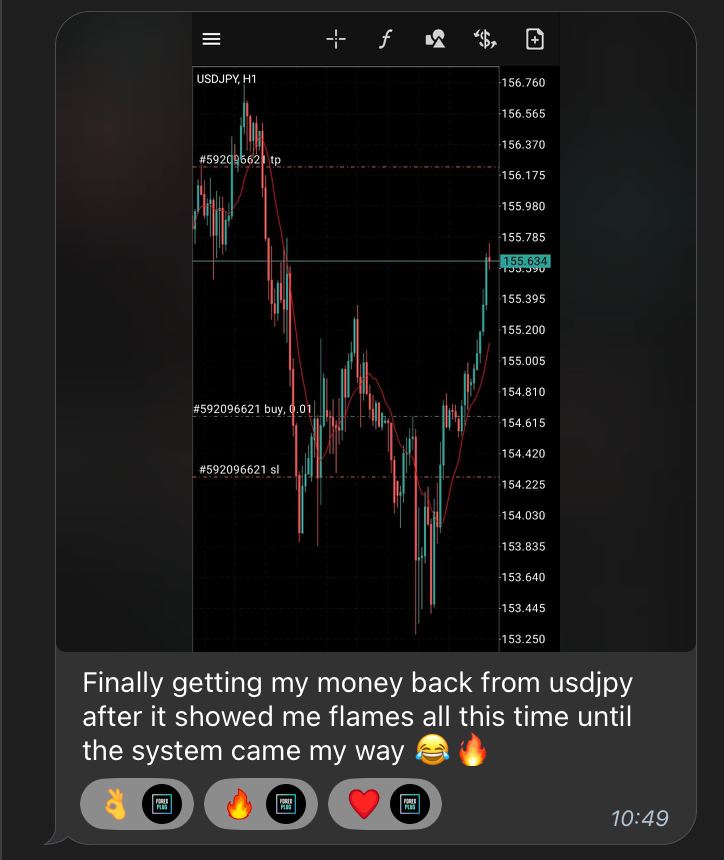

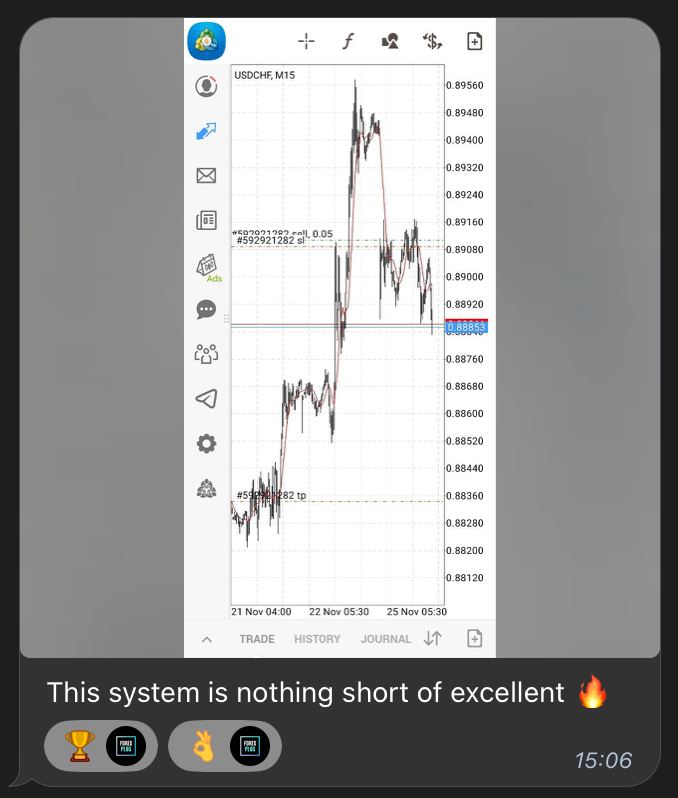

Client Success Stories

Real conversations with our members showing their trading journey and results

Experience our super sleek and futuristic trading solution for Metatrader. Our Linear Regression combined with Maximum Deviation Support and Resistance & ATR strategy has zero repaint logic displaying buy and sell setups including targets with simple time-efficient trading using our mechanical entry models.

Explore trading analysis concepts you will learn and gain experience with in your time trading with the Forex Plug System.

Master the art of spotting divergence between price and indicators—an essential skill for anticipating reversals and continuations. The Forex Plug System guides you in applying this advanced concept to real trades for greater precision.

Discover how to map out key support and resistance using classic pivot points. You'll integrate these levels into your daily routine, enhancing your ability to plan high-probability entries and exits.

Unlock the power of volume profile analysis to reveal value areas and likely turning points. Our training ensures you can confidently apply volume concepts to improve your trade selection and timing.

Gain hands-on experience using linear regression channels to define trend direction, strength, and fair value. The system teaches you to spot overbought and oversold conditions for statistically sound trades.

Explore the strategic use of Fibonacci retracement and extension levels. You'll learn to combine these with other tools for confluence, planning precise entries, exits, and targets.

Leverage artificial intelligence as your personal trade analysis assistant. With the Forex Plug System, you'll receive actionable AI-powered insights to review setups, manage trades, and continually refine your approach.

Follow these key checkups throughout the trading day to maximize your use of the Forex Plug System.

Understanding the statistical and mathematical principles that power the Forex Plug System

The Forex Plug System's foundation is built on the Least Squares Method for calculating linear regression. By analyzing 100 bars of price data, the system determines the line that best fits the recent price action, minimizing the sum of squared distances between price points and the regression line.

This regression line represents the statistical "fair value" of price over time, revealing the underlying trend direction and strength. The slope (m) indicates trend direction: positive for uptrends, negative for downtrends, with the magnitude reflecting trend strength.

Unlike simple moving averages that lag behind price, linear regression incorporates the entire price dataset to produce a more accurate representation of the current market trend.

The system calculates the maximum deviation of price from the regression line in both directions. These deviations determine the width of the channel around the regression line, creating dynamic support and resistance levels.

The calculation considers both upward (Ld_FFD0) and downward (Ld_FFC8) price deviations separately, allowing the system to account for asymmetrical price movements often seen in trending markets.

If the upward deviation is greater than the downward deviation, support and resistance lines are adjusted accordingly, ensuring they accurately reflect the actual price behavior rather than using fixed distances that might not represent real market conditions.

The Forex Plug System uses the Average True Range (ATR) to filter out market noise and identify significant price movements. By calculating ATR over the last 50 bars, the system establishes a dynamic threshold that adapts to current market volatility.

This threshold (Ld_FF98) is set at 0.6 times the ATR value, creating a balance between sensitivity and reliability. A lower factor would generate more signals but include more false positives, while a higher factor would miss legitimate opportunities.

This ATR-based filtering ensures that price movements qualify as significant only when they exceed normal market fluctuations, increasing the reliability of trade signals and reducing the likelihood of entering false breakouts.

For a buy or sell signal to be confirmed, the Forex Plug System requires multiple conditions to be met simultaneously, applying Boolean logic to filter out weak signals.

For buy signals, the system verifies that: (1) price is within the buy zone, (2) the current high exceeds the highs of adjacent bars (confirming upward momentum), and (3) the movement exceeds the ATR threshold.

Similarly, sell signals require: (1) price within the sell zone, (2) the current low to be lower than adjacent bars (confirming downward momentum), and (3) movement exceeding the ATR threshold.

This multi-factor approach reduces false signals and increases the probability of successful trades, allowing the system to maintain its impressive 85% win rate.

See the dramatic difference the Forex Plug System makes in real trading performance

Everything you need to know about the Forex Plug System

The Forex Plug System is a comprehensive trading solution designed to help traders identify high-probability opportunities using linear regression, support and resistance, and volatility analysis. The system provides clear entry and exit signals, customizable strategy settings, and a focus on risk management for consistent results.

This approach creates a powerful, efficient, and customizable trading system that delivers reliable results.

The Forex Plug System is designed to work best on the 5 minute, 15 minute, and 1 hour timeframes. These intervals provide the most reliable signals and optimal balance between trade frequency and quality.

The system can be applied to:

For optimal results, we recommend trading during active market hours (01:00-19:00 in the default settings) when your chosen instrument has the highest liquidity.

The Forex Plug System is designed to provide one high-quality day trade per day for each instrument you choose to trade. This approach prioritizes precision and quality, ensuring you focus on the best opportunities rather than being overwhelmed by excessive signals.

By concentrating on a single, well-validated setup per instrument, you can maximize your edge and maintain a disciplined, stress-free trading routine—regardless of market conditions or volatility.

Upon purchase, you will be added to our exclusive system education channel on Telegram, where you'll receive ongoing training, updates, and community insights. In addition, you benefit from lifetime one-on-one support for all trading and system-related topics, ensuring you always have expert guidance at every step of your journey.

Real conversations with our members showing their trading journey and results

Experience the future of forex trading with our sleek and advanced Forex Plug System. Enhanced features, improved accuracy, and simplified trading.

Unleash the full power of our Forex Plug System with a single payment

Join thousands of traders already mastering the markets with our enhanced Forex Plug System

Upgrade Today